Lots of noise is distracting from what should be a pretty simple voting decision on the GPPSS bond proposal

The intricacies of tax laws, ballot wording, school funding, politics, understandable emotion around our community’s children has created a lot of noise and confusion – even anger and mistrust.

In this piece, I’ll try to stay as close to the middle as I can, although in my last post I acknowledged I will be voting against the GPPSS Bond Proposal.

Category 1: You oppose any tax increase to fund building repairs and construction whether by bond or Sinking Fund. Your research leads you to conclude that there’s plenty of money available from current sources. Under no circumstances would you ever support a tax increase for a bond or Sinking Fund or anything else. You are probably going to vote no on the bond

Category 2: You agree the GPPSS needs to increase tax revenue immediately and cannot wait even one year more because the immediate needs are dire. You agree that the needs are so pressing that taxpayers should bear the projected $71 million in interest expense the proposed $111 million bond would incur. You understand that the interest is incremental to the $111 million. You agree with (most) everything the district has said they will do with the new tax revenue. You think a Sinking Fund alternative will bring in money too slowly, or not enough money. You think those opposed to the bond will never want to increase taxes at all. You are probably going to vote yes on the bond.

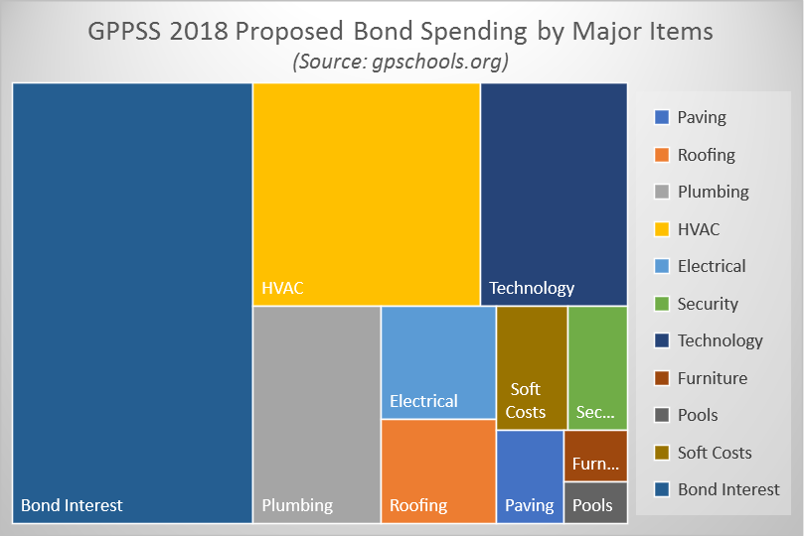

Category 3: You agree that taxpayers really do need to increase tax revenue to pay more for building repairs. You are concerned that the district’s bond financial advisers have projected it will incur $71 million in interest expense. You disagree that the majority of the major repairs must be done over the next 3 to 5 years and not worth the interest expense. Perhaps you don’t think all $111 million of the ‘Critical Needs’ as identified by the district are truly critical. You conclude the truly critical projects, such as roofs, HVAC, electrical, roofing, plumbing and paving, and security can be staged over the next 10 years. You agree that the Sinking Fund could be increased from 1 mill per year to 3 mills per year. You agree with the projections that GPPSS’ taxable value will increase about 2% per year. You calculate that over the next ten years, a 3 mill Sinking Fund would yield $85.4 million of tax revenue – with no interest expense. You are probably going to vote no on the bond and should actively support raising the Sinking Fund from 1 to 3 mills for the next ten years.

Category 4: You are undecided for any number of reasons, but open to the idea at some point to a tax increase to fund building repairs. You want to do more research and hear an alternative, likely one that involves a combination of bond and sinking fund. You are probably going to vote no on the bond, but at some point are likely to promote a tax increase of some type.

Some specious arguments:

“But the Sinking Fund will actually cost more than a bond!”

Complete nonsense. Spinners are being fast and loose with millage rates or comparing apples and oranges. The district projects the bond to cost taxpayers $111 million in principle and $71 million in interest. The millage rate to get that yield starts at 1.5, but will average 2.21 over the life of the bond payment schedule. Yes, increasing the Sinking Fund from 1 to 3 mills delivers a higher immediate tax increase, but it avoids the interest cost of a bond.

“There is no other option than the bond! There is no plan B!”

Silliness and an example of the fear, uncertainty and doubt approach that make people skeptical. Of course there are options. The Sinking Funs IS an option.

“The district’s Blue Ribbon Committee concluded that the bond promoted here is the best (or only) way. We have to trust this recommendation”

Being skeptical of proposed tax increases is older than our republic. Perhaps the Committee did reach this majority, or maybe plurality position. Why resort to shaming those who still oppose it for logical reasons? One thing GPPSS voters are not is stupid. It is pissing them off that this is being implied by those making these and other specious arguments.

“The teachers have taken huge pay cuts so we must support this bond!”

I don’t even know where to go with this one. This argument simply trades on fear and emotion to support a bond yes vote. Frankly arguments like this detract from the credibility of those who make them and is a major reason why GPPSS taxpayers are skeptical of the district. Even if you are inclined to accept this argument, it breaks down if you support a 3 mill Sinking Fund.

“If we don’t support this bond, teacher pay will be cut.”

A variant of the argument above. Complete nonsense.

The sky is not falling. I look forward to hearing the voice of the people resulting from this vote and, as always, the district will decide wisely from there.

Go vote November 6th!

One response to “Keeping it simple”

Brendan, you imply that the majority of GP tax payers are skeptical of the district. That’s your impression, but it is not mine. A very small minority of the tax payers have any view of the schools at all. They don’t follow the decisions of The School Board, and they do not vote at all when it comes to voting for school board elections. I would say that there is a very small minority of self identified conservatives who have historically been very negative about school administrators and the school board in general. They are playing hardball to make sure the bond will be defeated. And they seem to have more money to launch a noisy campaign. We can have this conversation on more concrete grounds next Wednesday. The vast majority don’t have a clue who is running for school board seats, and most of them will vote yes on the bond if their politics tend to be liberal, and no if they are conservatives. That’s my two cents worth. And yes, I moved away and no one is contentious when it comes to millages and school board elections here.