Correction: A reader rightly corrected the original version of this post that reported Michigan law required school employees to contribute 10% to health care premiums when in fact the law, passed in 2011, requires a 20% contribution. This correction does not change any of the figures, which are actual figures provided by the GPPSS. Also of note, none of the figures below capture the $3.4 million spent in 2010-11 and 2011-12 that went to employees who took the Early Retirement Incentive (ERI) that was part of the May 2010 contract settlement.

This one is wonky and technical so I’ll begin with the punchline for the TL;DR crowd.

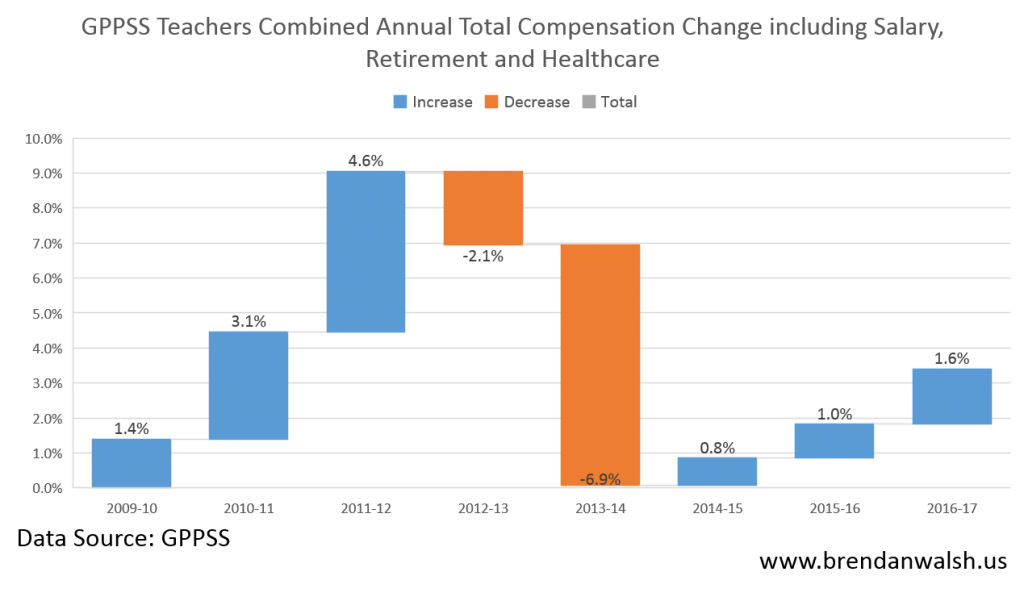

An examination of total compensation for the majority of GPPSS teachers shows that from 2009-10 through 2016-17 total compensation will have increased on average by 3.4% while district revenues are flat. If we compare 2007-8 revenues to this year (2015-16), district revenues are down by over $9 million (or about 9%).

If on Monday the Board follows the collective bargaining agreement, the 3.4% total compensation increase will become about 2.5%. Instead of a 1.8% raise next year, employees would get about a 1% raise. Under no condition would salaries be cut and please correct those who make that inaccurate claim.

So let’s dig deeper to explain the numbers.

We start with a waterfall chart that shows the annual percentage change in employee total compensation – salary, retirement and healthcare – for teachers who were employed by the district in 2010 or before, the year we struck the deal that largely governs our compensation system.

As salary, retirement and healthcare contributions are factored against the previous year’s baseline, we track the annual change. In 2009-10 through 2011-12, total compensation increased by 9%. This is when the district lost $18 million in fund equity. A loss of this magnitude proved the district could not afford the compensation we provided. The numbers prove this beyond dispute.

From 2012 to 2014 the contract clause and the March 2013 contract adjusted salaries to offset raises and other compensation increases (that we will review below). From 2014-15 through 2017, compensation is again on the rise and the fund equity targets agreed to way back in 2010 are still not being met.

Hello, Darkness, my old friend.

From 2008-9 until now, district revenues are down 8% yet we tried to increase compensation at the same time. Obviously this didn’t work before and it won’t work now. The current debate is not about whether our employees are worth it or whether we value them. It’s simply whether we can compensate them based on state dictated revenues.

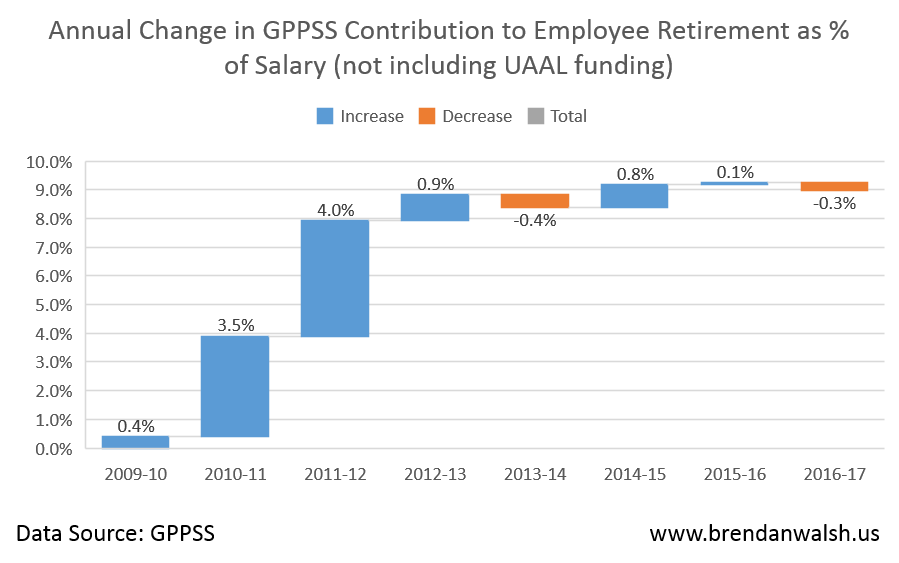

So let’s go even deeper into the numbers to understand what has happened and return to the emphasis on total compensation. Board members, administration and the community are prone to the bad habit of ignoring retirement (pension and health) compensation which just so happens to be the fastest growing element of the total compensation package and the most problematic aspect of the district’s budget for the last ten years.

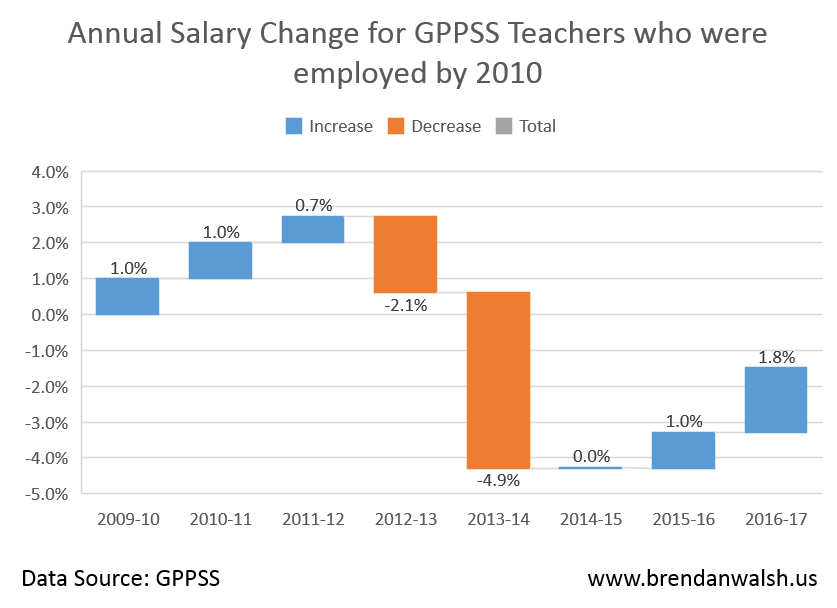

Let’s look at the annual change in these three main components of compensation (salary, retirement and healthcare) starting with salary. I focus here on the employees who were employed by the district at the time of the May 2010 deal, but I suspect new employees are experiencing similar percentage changes. I am using the publicly available contract data and am factoring only step change increases or decreases. This under-counts the actual increase because undoubtedly teachers have increased in lanes as well. But anyways, here’s the data.

So for those who decry that their salary now is lower than 2010, you are right. On average, your base salary is down by 1.5% IF we factor the 1.8% raise scheduled for next year and if we DON’T count any lane changes. Without next year’s 1.8% increase, the net effect has been a 3.3% salary reduction.

“But my paycheck is much lower than that!,” you say.

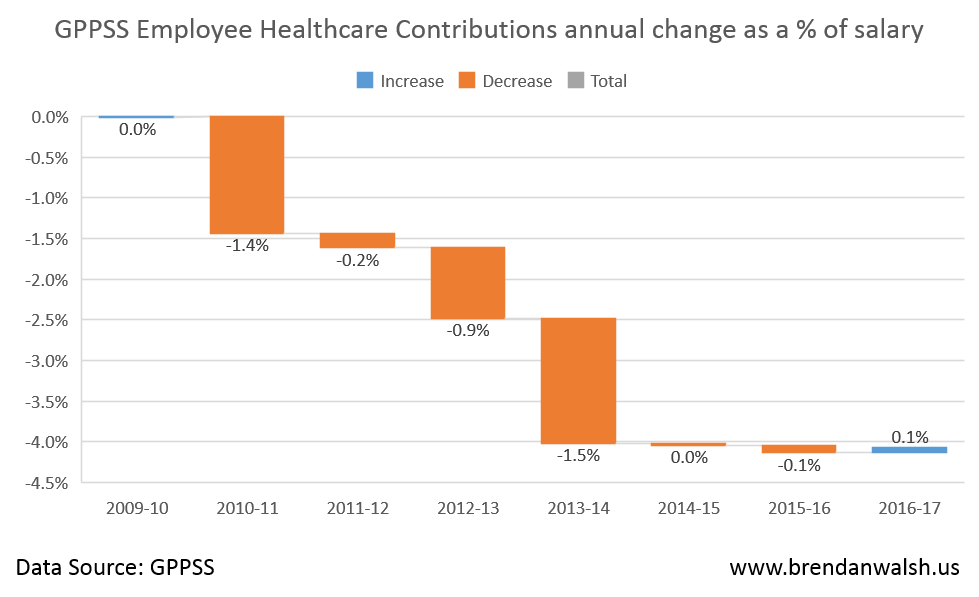

Again, probably true IF you participate in the district healthcare plan that historically 75% of employees have. And since the state mandated employees pay 20% of premiums and as of 2009 district employees paid nothing for healthcare premiums, this means employees are seeing a greater deduction in their paycheck – something every employed American everywhere is experiencing.

Since we cannot do this on an individual basis, we can only take an average and this is the aggregate effect of healthcare premium contributions as a percentage of salary.

This means that in this time period, state mandated healthcare premium contributions have had an aggregate net effect equivalent to a 4.1% loss of salary (even though it’s not a loss, but rather a cost of a benefit). For 75% of employees that number will be higher and for 25% it will have no effect. So this is the average.

If you’re keeping score so far, the aggregate effect – on average – of salary and healthcare compensation changes from 2009 through 2016 is a negative 7.4%. But we’re saving the best (or worst) ’til last. Here comes retirement benefit.

And THIS is where employee compensation has experienced its greatest increase – a total of 9.2% from the time we did the May 2010 deal through this year which more than outpaces the 7.4% reduction from salary and healthcare based compensation.

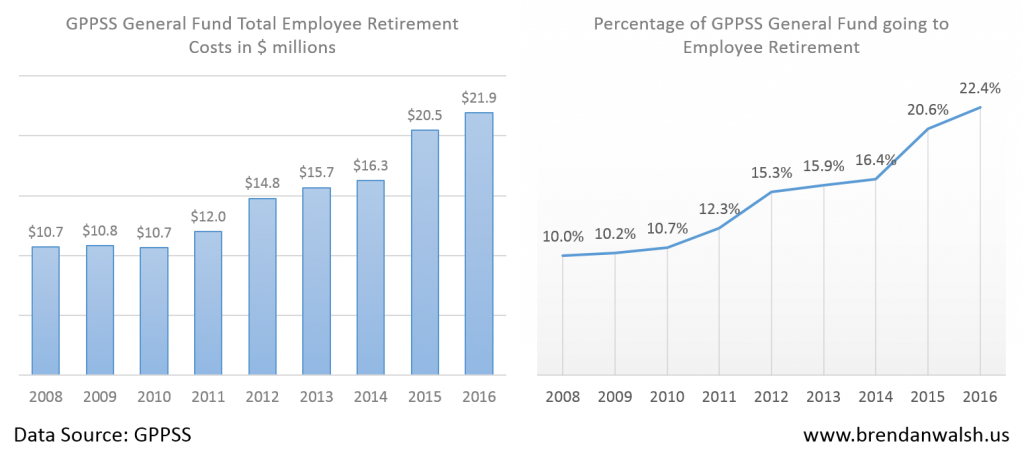

Here are two charts that shows the increasing cost of employee retirement costs in the GPPSS’ General Fund budget.

This year the district will spend over $21.9 million to fund employee retirement – double our 2008 cost. Retirement costs are the biggest problem plaguing Michigan public schools (especially the GPPSS) and everything else is a distant second. I understand the frustration of employees who do not see a line item in their paychecks showing this form of compensation, but as we can all see in this chart it is a very real – and rapidly rising – cost. It’s also a very real benefit that our wonderful employees will someday enjoy.

What the GPPSS Formula clause does is address the funding issue created by the state when it increases district retirement costs, but does not fund the cost of the increases. Since Proposal A completely eliminates our ability to increase General Fund tax levies, we have two choices to respond to this problem:

- Ignore the root cause issue and annually cut programs and core services costs and do otherwise unpopular things (raise class sizes, participate in schools of choice, close schools, outsource staff, reduce course offerings, increase fees, raise other taxes, etc.), or…

- Treat the root cause issue and have employees increase their contribution to the benefit they will one day enjoy.

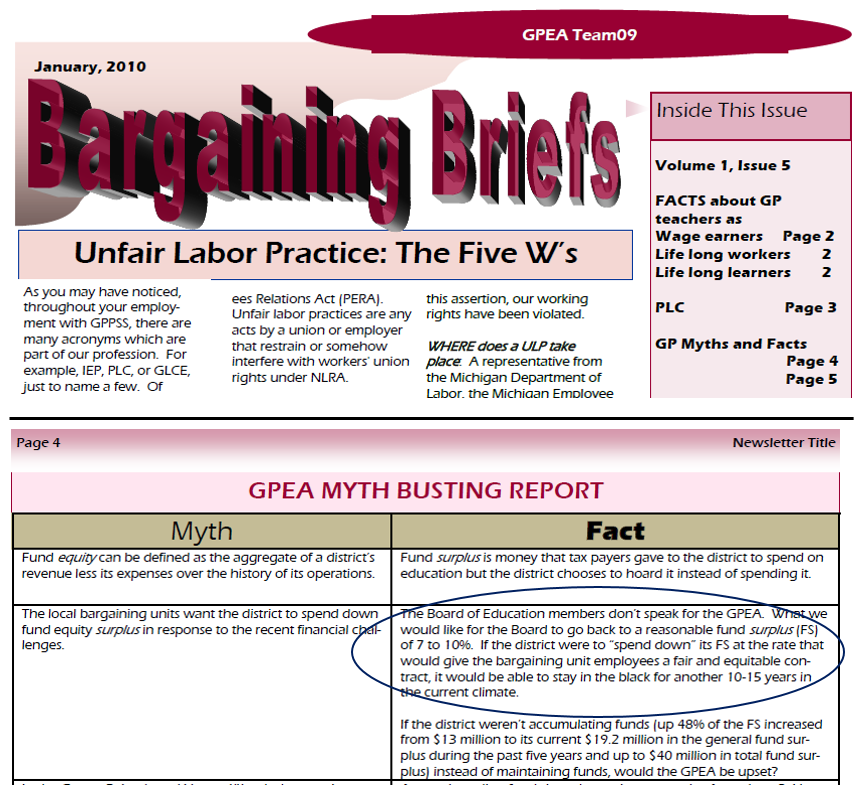

This was the debate at the bargaining tables in 2009. The GPEA maintained the district COULD afford the compensation for which they bargained, frequently pointing to our once $20 million of fund equity. They were quite public that the district could afford this. Here’s their member newsletter from January 2010:

If I could pinpoint the crux of the issue and the biggest driver for the formula clause, it’s this circled part. The GPEA argued the GPPSS Board could afford what the GPEA deemed a “fair and equitable contract” so long as “the current climate” remained the same. The Board rightly said, “OK, but what if ‘the current climate’ changes for the worse?”

The answer to this question became the 10% fund equity clause (that I won’t rehash here. Please review my blog for the many past entries.)

So what got worse? See the retirement charts above as well as my last post about why the issue the GPPSS Board will take up Monday is so critical. Retirement costs doubled and revenue decreased. This is why we bargained for and essentially paid $10 million for the 10% clause – to protect against the very thing we were worried would happen.

We know what happens when we ignore the effect of rising retirement costs and treat everything but the root cause issue, the question now is whether we will ignore what we learned.

2 responses to “The danger of ignoring total compensation”

Well researched as usual. The charts and graphs are very helpful.

[…] The financial and contract structure of the GPPSS established that fund equity should be about 10% of the total annual spend in the district. This translates to about $10 million. This target was set in 2010 when the district’s fund equity was at about $20 million. As of today, the district estimates fund equity of about 7%, or about $3 million under the target. To understand why we experienced such a reduction please read my entry from last May, The Dangers of Ignoring Total Compensation. […]