At the end of the 2008-9 school year, the Grosse Pointe Public School System had $20 million in General Fund equity and ran almost a perfectly balanced budget. By the end of 2012-13 fund equity was $2 million. How did it happen?

The short version is that state funding cuts and declining enrollment reduced revenue by $30.4 million. In the same time, $30 million in cost reductions were found, but other costs increased by $17.4 million. The net effect was an $18 million loss of fund equity.

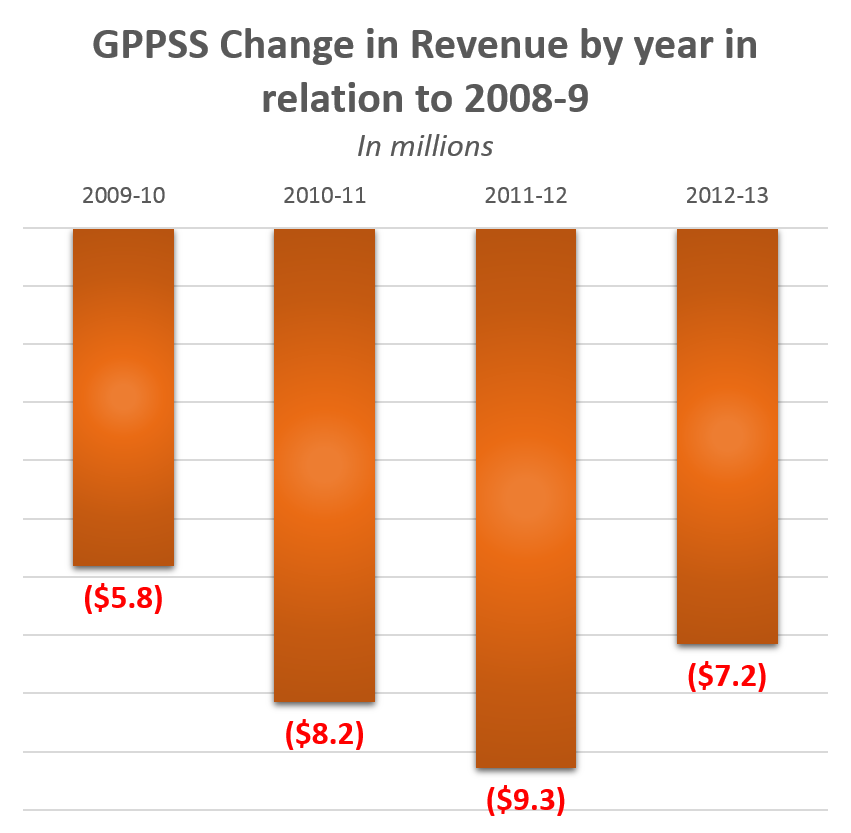

This first chart shows the revenue variance from 2009-10 through 2012-13 in relation to 2008-9 when the budget was balanced.

From 2008-9 to 2009-10 the GPPSS experienced a $5.8 million revenue loss, the majority of which was the result of then Gov. Jennifer Granholm’s cuts of October 2009. That same $5.8 million persisted and got worse in the ensuing two years. Revenue was moderately increased from 2011-12 to 2012-13, but nowhere near the earlier losses. (More details on revenue patterns here.)

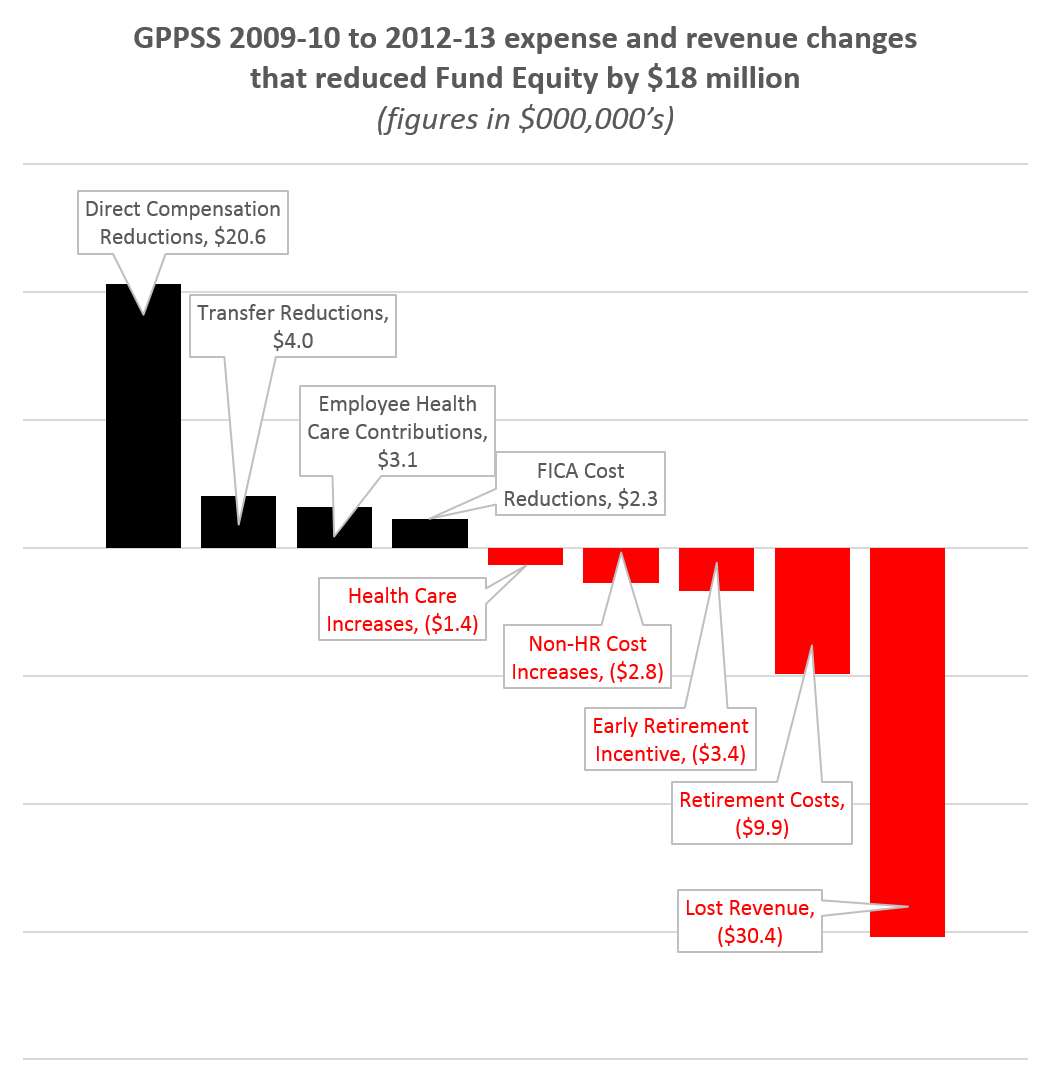

The second chart here sums up all the expense and revenue categories that affected fund equity from 2009-10 through 2012-13.

The black bars represent shifts that work to preserve fund equity. Those total $30 million. The red bars work against fund equity. You see again the $30.4 million in lost revenue wipes out the total effect of the black bars (and then some). It’s the other four red bars that generated the vast majority of the $18 million drop in fund equity. The biggest culprit – again – is ever increasing retirement costs. (See recent post on retirement costs for more detail.)

These charts may beg the question, how did the district generate $20.6 million in compensation reductions? Was it the contract formula clause?

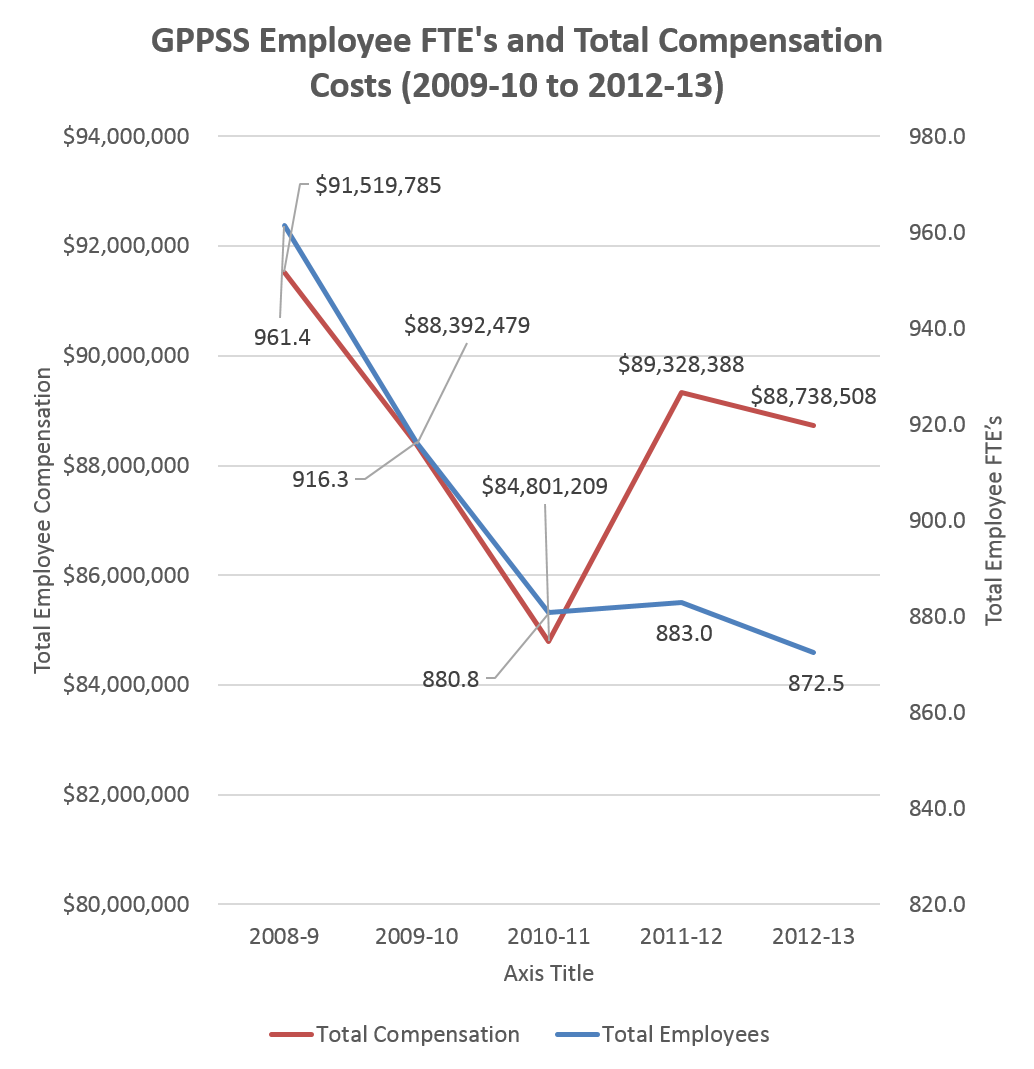

The short answer to the second question is no. The biggest contributor to direct compensation cost reduction was job reduction. From 2008-9 to 2010-11, the district cut 80 full time equivalent positions. Also, the effect of the early retirement incentive (ERI) replaced dozens of our most highly paid staff with new employees who received significantly lower salaries.

The formula clause did not kick in until 2012-13 and even then, it reduced direct compensation by about $2.7 million. This means that 90% of direct compensation reduction is attributable to job reduction or the ERI effect. Meanwhile, as the second chart above shows, total compensation costs were increasing due mainly to rising retirement costs. The chart below summarizes the problem of relying on job reduction to balance the budget.

So in 2011-12, despite 78 fewer employee FTE’s (or 9.2%), the district’s total compensation costs were just $2.2 million lower (or 2.4%). About half the cost increases from 2010-11 to 2011-12 were retirement increases. The other half is attributable to direct compensation cost increases.

Of course history proved this did not work. The district was running annual deficits that averaged $4.5 million per year from 2009-10 to 2012-13.

In summary, the $18 million drop in fund equity is primarily attributable to rising retirement costs and significant reductions in state revenue. The ensuing employee contracts are essentially adjusting employee compensation to respond to those two state driven issues. As we’re seeing now, fund equity will return to 10% – the agreed upon levels – by 2016-17 and job loss has been stemmed.

6 responses to “Where did the $18M in fund equity go?”

It is also important to note that during this time, there were serious discussions in State government to reduce compensation to districts that were above a certain fund equity level. So the board and administration worked to determine a list of needed expenditures, with local control determining what those would be, rather than wait for cuts to be imposed to our allocation for having been wise stewards of our fiscal resources.

[…] The district ran a $3.7M budget surplus when it had expected to run a $2M surplus. This ended a four year run of annual deficits that saw fund equity lose over $18M (details on how here.) […]

[…] the budget is proving stable having run a surplus now for two straight years after five years and $18 million of deficits. Teacher salaries remain among the best in the state, and class sizes remain low, on the whole, in […]

[…] Quick analysis: Given the lower than expected 2015 actual expenses, fund equity increased by $1.2 million better than the June Final Budget, or $1.9 million overall. This is the second straight annual budget surplus after the $18 million aggregate loss from 2010 to 2013. […]

[…] 14% at the end of 2014-15 school year. The March 2013 contract delayed that return by design. Sharp reduction in fund equity levels (all the way to 2%) would trigger equally sharp employee compensation reductions – as […]

[…] In 2009-10 through 2011-12, total compensation increased by 9%. This is when the district lost $18 million in fund equity. A loss of this magnitude proved the district could not afford the compensation we provided. The […]