Signs of Michigan’s economic recovery are instigating conversation not heard in over a decade. As a result of rising employment, improved Detroit 3 car sales, and a variety of other factors, the people of the state of Michigan are more economically active and tax revenue estimates – such as those issued by the Senate Fiscal Agency last week – are more favorable than they have been in years.

This excerpt from the Senate Fiscal Agency (SFA) report sums things up nicely and offers some context: “Wage and salary employment is predicted to continue growing, increasing 0.4% during 2012, 0.1% in 2013, and 1.0% in 2014. The 1.7% increase during 2011 was the first increase in wage and salary employment since 2000.”

That’s right, twelve long hard years.

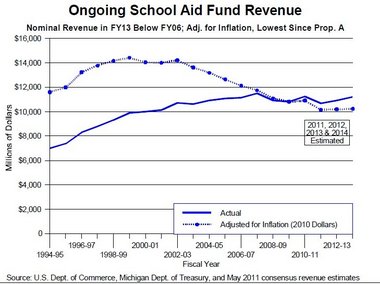

As it relates to school funding, this news has sparked a healthy debate with many citing it as evidence that increased tax revenues should bolster a School Aid Fund that, in real dollars, is at its lowest point since voter approval of Proposal A nearly 20 years ago. The chart on the left from the SFA report provides a strong visual of what has happened to School Aid Fund since the passage of Proposal A.

As it relates to school funding, this news has sparked a healthy debate with many citing it as evidence that increased tax revenues should bolster a School Aid Fund that, in real dollars, is at its lowest point since voter approval of Proposal A nearly 20 years ago. The chart on the left from the SFA report provides a strong visual of what has happened to School Aid Fund since the passage of Proposal A.

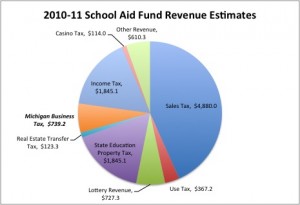

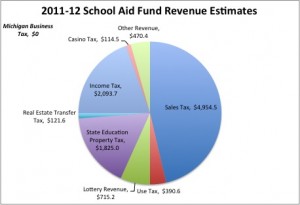

As for the most recent drop in revenue, I put together these two charts using the SFA report to contrast 2010-11 and 2011-12 estimated School Aid Fund revenue by tax source.

Of greatest note is the $739 million in Michigan Business Tax revenue present in 2010-11 that dropped to zero in 2011-12 as a result of the tax overhaul enacted by the Snyder Administration. Also noteworthy is the continued rise of sales tax as the predominant revenue stream for the School Aid Fund – 46% in 2011-12 compared to 17% from property tax.

These charts present a strong visual and are good examples of the benefit of trending data, something I have worked very hard to present in the many financial transparency reports I have created. Trend is important because it provides the sense of motion, speed and direction that a point in time snapshot simply cannot provide. Left just to a trend analysis alone, it’s easy to see why many would call for diverting better than expected tax revenue dollars back into the School Aid Fund.

What these charts do not show, however, is how the state of Michigan compares to other states in education tax and spending policy – what is called benchmarking.

We’ve gone to great lengths to provide best in class financial benchmark reports for the Grosse Pointe Public School System that have proven to be incredibly informative to our own financial decision making. But how can we benchmark the state of Michigan?

One tremendous data source is the National Education Association’s Annual Rankings and Estimates Report. In fact, this report has so much data it’s hard to process it all. But I reviewed it with an objective eye and suggest the following for consideration

The first number is Michigan’s rank among the 50 states and Washington D.C. All data is from 2008 unless otherwise noted.

- 37th – Per Capita Personal Income ($35,321)

- 51st – Change in Per Capita Personal Income from 1998-2008 (31.3%)

- 20th – State & Local Government General Expenditure per $1,000 of Personal Income ($205)

- 10th – State & Local Expenditures for All Education per $1,000 of Personal Income ($80)

- 3rd – Public School revenue per $1,000 of Personal Income ($56)

- 2nd – Expenditure for Public K-12 Schools per $1,000 of Personal Income ($52)

These powerful data points remind us once again of the “New Normal” argument. Michigan plummeted in the rankings in per capita income and was dead last in the country in income growth in the ten year period from 1998 to 2008. But spending patterns didn’t adjust down in the same proportion and as a result our expenditure for K-12 schools as a percentage of personal income is 2nd highest in the country.

That is hard to justify and probably the single biggest driver for Gov. Snyder in his rationale to see the School Aid Fund take a three quarters of a billion dollar hit through the reduction of the Michigan Business Tax. This data is also probably how Gov. Snyder would respond to those who are calling for an increase in School Aid Fund revenue sources.

This is not the answer public school advocates like myself want to hear, but we simply have to be objective in our analysis if we want long-term solutions. Yes, we are recovering but are decades away from regaining the losses from Michigan’s darkest decade.